Etihad Credit Insurance selects winning companies from ‘Xport Xponential’ initiative submissions

• 42 companies applied to join the initiative

• A training workshop will be organised to highlight crucial aspects and determine mechanisms for selected applicants

15 January 2025: Etihad Credit Insurance (ECI), the UAE’s federal export credit company, announced the names of winning companies that will be joining its recently launched Xport Xponential initiative, which aims at supporting the UAE’s export sector and empowering UAE-based companies to expand into global markets.

ECI stated that the finalists were carefully selected out of 42 companies that applied to join the initiative within the deadline. These companies, hailing from diverse economic sectors, successfully met the criteria established to join the initiative and will avail all benefits it offers. The initiative aims to achieve a significant growth in export activities for the finalist companies, commencing this year.

Xport Xponential offers an array of facilities, support services, and enabling tools, which include innovative credit and financing solutions, strategic consulting, expert guidance, and risk management solutions, in collaboration with a network of government and private sector partners. The initiative also enables seamless access to a database of over 400 million global companies.

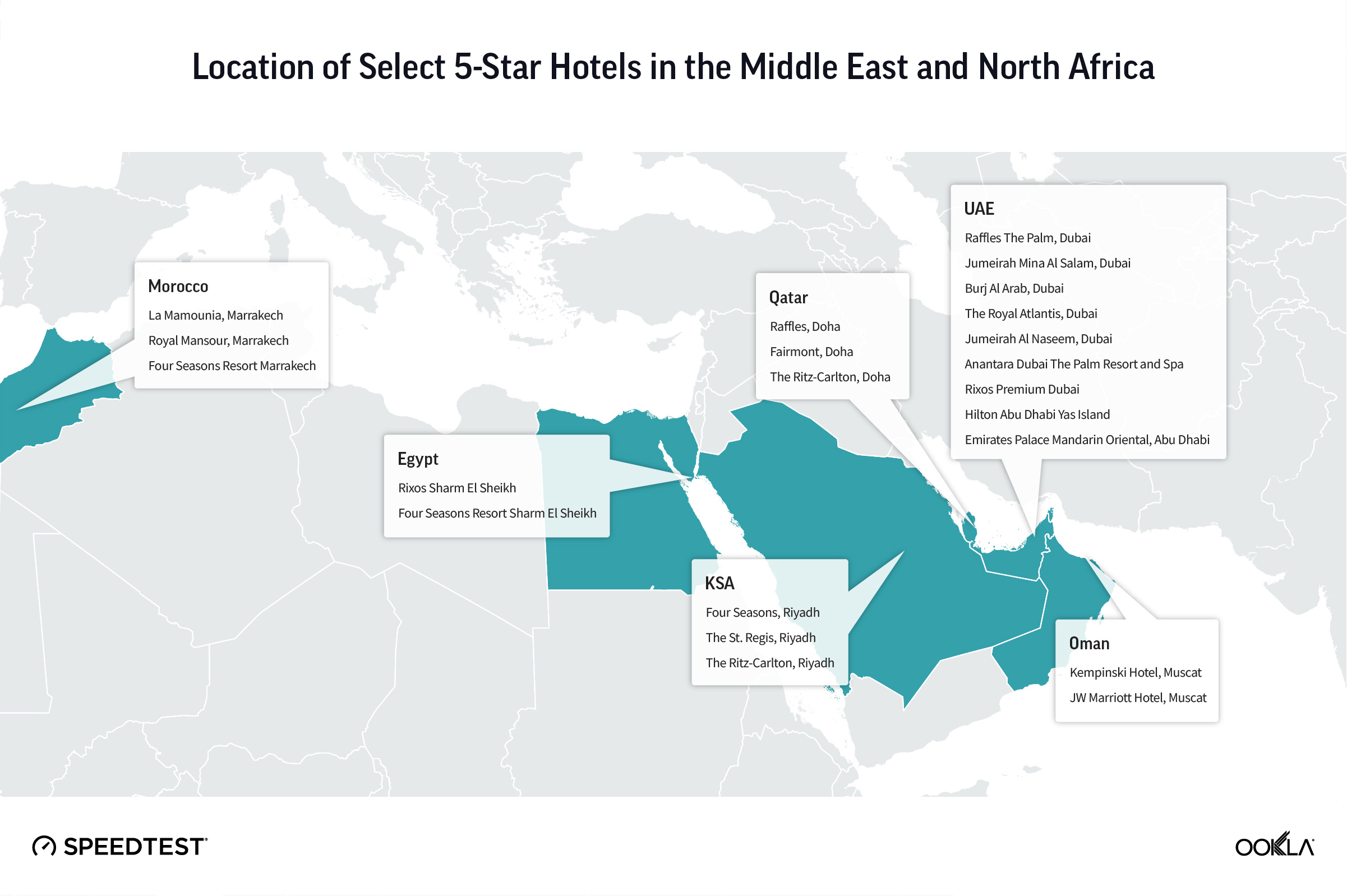

This expansive network includes a wide variety of credit agencies, exporters and importers in key global markets, particularly from those countries that have signed Comprehensive Economic Partnership Agreements (CEPAs). At the end of last year, the total value of export and re-export activities with these countries amounted to approximately AED 390.5 billion, which facilitated significant trade and export advantages for achieving the country’s economic objectives and positioning it as a major trade and logistics hub. This includes enhanced access to global markets, reduced or eliminated tariffs, streamlined customs procedures, promotion of fair trade, as well as the establishment of clear and transparent regulations.

H.E. Raja Al Mazrouei, CEO of ECI, said: “We are eager to collaborate closely with and support the companies selected to join our Xport Xponential initiative. Our goal is to empower businesses within the UAE’s export and re-export sectors, enhancing our role in the growth of exports and foreign trade in the UAE.

“This initiative underscores our commitment to offering credit, financial, and advisory support tools that can significantly increase non-oil product exports from the UAE. Through this initiative, we aim to expand our partnerships, reinforcing collaboration with key stakeholders and promoting the diversification and sustainability of our national economy, in alignment with the ambitious vision of our esteemed leadership,” Her Excellency added.

Furthermore, ECI will organise a one-day workshop, with the participation of representatives from the finalist companies. The workshop aims to provide guidance, instructions and training on the initiative. It will focus on a range of topics, primarily centred on preparing participating companies for the next steps.

ECI is set to arrange roadshows in several countries, aiming to introduce the initiative in nations that have signed Comprehensive Economic Partnership Agreements (CEPAs), in collaboration with the Ministry of Foreign Affairs (MOFA) and Ministry of Economy (MoE), among other relevant entities.

Till date, partners in this initiative include various federal and local entities, including Abu Dhabi Department of Economic Development, Khalifa Fund for Enterprise Development, Department of Economy and Tourism in Dubai, Dubai Airport Freezone, Sharjah Chamber of Commerce and Industry, Ajman Department of Economic Development, Ras Al Khaimah Economic Zone (RAKEZ), and Department of Industry and Economy - Fujairah. It further includes financial and banking institutions, such as Emirates Development Bank (EDB), Abu Dhabi Commercial Bank (ADCB), First Abu Dhabi Bank, Dubai Commercial Bank, Ajman Bank, the National Bank of Ras Al Khaimah, the National Bank of Fujairah (NBF), International Development Bank (IDB), Wio Bank PJSC, and Al Maryah Community Bank.

-Ends-