Ministry of Economy inks MoUs with key national entities to boost cooperation in combating money laundering and financial crimes

Agreements define clear frameworks for technical cooperation, knowledge exchange, and capacity building while ensuring data privacy compliance

Abu Dhabi, April 18, 2025: The Ministry of Economy signed a series of MoUs with several competent national authorities in the field of anti-money laundering and countering terrorism financing, including the Economic Security Centre of Dubai (ESCD) and the Dubai Land Department (DLD). The agreements aim to strengthen national efforts in developing the regulatory infrastructure, enhancing integrity and transparency systems, and improving mechanisms to combat financial crimes in accordance with international best practices. The MoUs also facilitate the exchange of data and information, while supporting the Ministry’s supervisory role under the relevant national legislation.

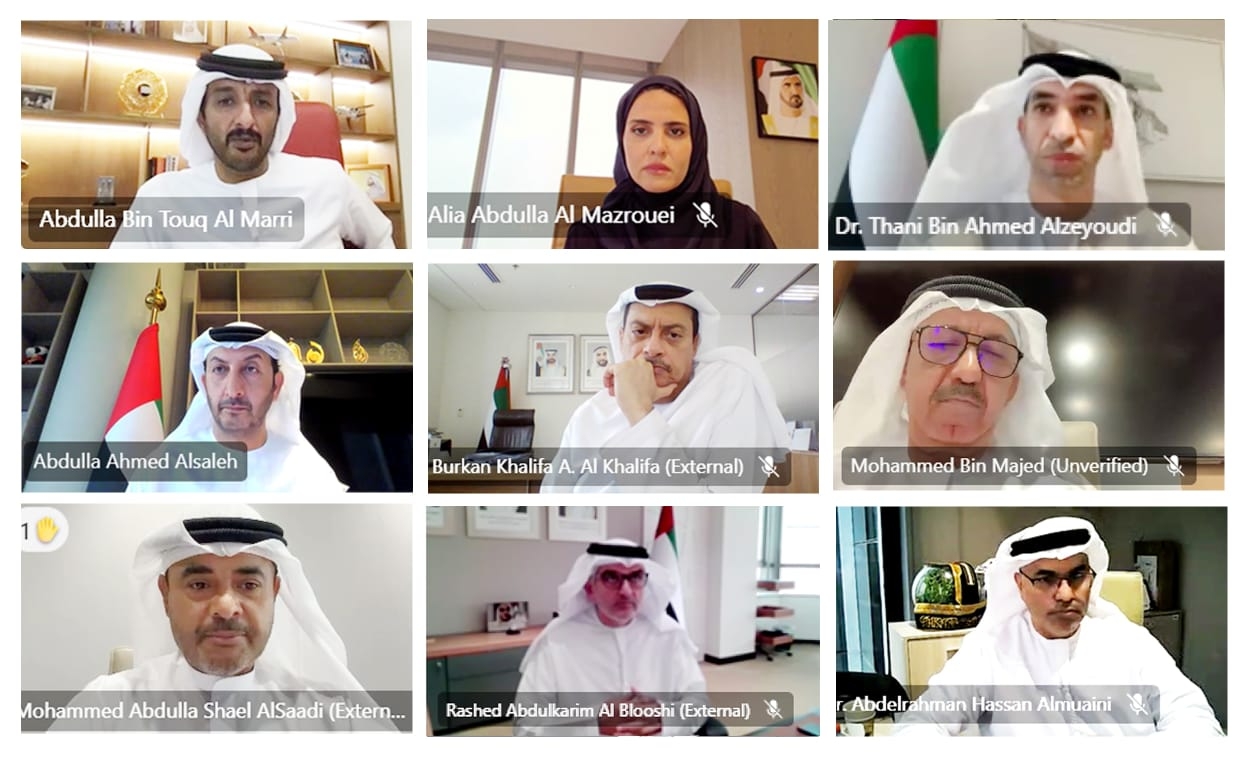

The signing ceremony was held on the sidelines of the “Role of the Designated Non-Financial Businesses and Professions (DNFBPs) Sector in Combating Financial Crimes" summit, which took place recently in Dubai. It was attended by H.E. Abdulla bin Touq Al Marri, Minister of Economy; H.E. Abdulla Sultan bin Awad Al Nuaimi, Minister of Justice; and H.E. Ahmed Al Sayegh, Minister of State. The MoUs were signed by H.E. Abdulla Ahmed Al Saleh, Undersecretary of the Ministry of Economy; H.E. Safeya Hashem Al Safi, Assistant Undersecretary for the Commercial Control and Governance Sector; H.E. Faisal Yousef bin Selaitin, CEO of the Economic Security Center of Dubai; and H.E. Majid Saqr Al Marri, CEO of the Real Estate Registration Sector at the Dubai Land Department, along with other government officials.

The initiative is part of continuing efforts to strengthen institutional integration and partnerships to improve monitoring and compliance systems and facilitate the exchange of data among signatories, in support of their shared objectives to counter financial crimes in the UAE.

The MoUs establish clearly defined frameworks for technical cooperation, capacity building, and knowledge exchange, as well as secure data sharing mechanisms that ensure confidentiality and compliance with relevant legal and regulatory frameworks.

Representatives of the signatory entities affirmed the importance of enhancing national efforts to address the challenges of money laundering, terrorism financing, and the proliferation of weapons, through a sustainable and institutional approach. They emphasized that such efforts support the UAE’s readiness for the upcoming mutual evaluation, help ensure high levels of legislative and regulatory compliance and improve efficiencies in addressing cross-border financial crimes. These measures also contribute to achieving sustainable economic growth and improving the country’s ranking in global competitiveness indices. The representatives reiterated their full commitment to supporting initiatives that protect the national economy and strengthen financial security.

-Ends-