Summit highlighting the role of DNFBPs sector in fighting financial crimes kicks off in Dubai

Organized by the Ministry of Economy and the Executive Office for Control and Non-Proliferation

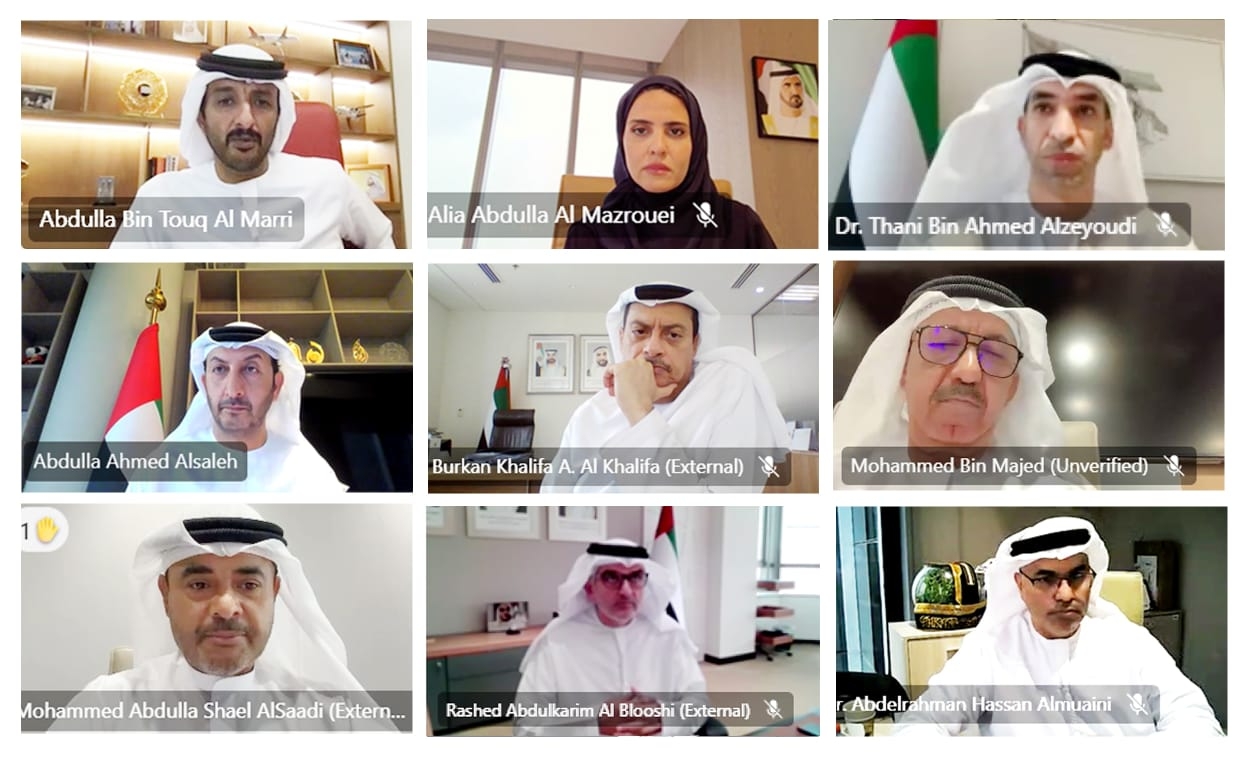

Dubai, April 17, 2025: Under the patronage and in the presence of H.E. Abdulla bin Touq Al Marri, Minister of Economy, and H.E. Ahmed Al Sayegh, Minister of State, the “Role of the DNFBPs Sector in Fighting Financial Crimes” summit kicked off in Dubai. Organised by the Ministry of Economy and the Executive Office for Control and Non-Proliferation (EOCN), the two-day event, taking place on April 16 and 17, aims to highlight national efforts, underscore the importance of enhanced compliance with international standards, and strengthen cooperation between the public and private sectors in combating terrorism financing and the proliferation of arms.

The summit serves as a key platform to raise awareness on the updated national and international requirements set forth by the Financial Action Task Force (FATF), with a focus on customer due diligence and verification procedures in alignment with targeted financial sanctions aimed at preventing terrorism financing and the proliferation of arms. It also seeks to empower the DNFBPs sector, which includes real estate agents and precious metals dealers, to effectively implement the latest regulatory measures.

In his opening remarks, H.E. Abdulla bin Touq Al Marri, Minister of Economy, emphasized that the UAE, guided by the directives of its wise leadership, has adopted advanced and forward-thinking strategies and legislations to build an integrated national framework to combat money laundering and terrorism financing. These efforts, aligned with global best practices, have significantly bolstered the UAE’s global economic reputation, reinforcing its status as a competitive economic hub committed to the highest standards of integrity, transparency, and regulatory excellence in financial and commercial oversight.

H.E. Bin Touq noted that the UAE has introduced a comprehensive set of legislations and policies aimed at reinforcing its anti-money laundering framework—positioning it among the most advanced legislative systems globally. More than seven key legislations and policies were enacted within a span of just four years, specifically between 2020 and 2024. Furthermore, the UAE remains steadfast in its commitment to supporting global efforts to combat financial crimes by adhering to the standards of the Financial Action Task Force (FATF) and deepening cooperation with partners at both the regional and international levels.

H.E. said: “We firmly believe that the private sector, particularly the DNFBPs, represents the first line of defense in the fight against financial crimes. Their proactive role in promptly identifying and reporting suspicious transactions is essential to empowering the competent authorities to detect and investigate illicit activities, hold offenders accountable, seize unlawful proceeds, and enforce relevant sanctions. These efforts play a critical role in cultivating a secure and transparent business ecosystem and maintaining a stable economic environment - further enhancing the UAE’s standing as a safe, reliable, and attractive destination for investment, both regionally and globally.”

His Excellency added: “The summit s happening at a time when the regulatory and control environment for combating money laundering and countering terrorism financing is undergoing rapid developments. It serves as a key national platform for strengthening dialogue, enhancing communication, and fostering integration between regulatory bodies and the private sector across the UAE.”

H.E. continued, “Through this platform, we aim to advance joint collaboration to enhance the preparedness of Designated Non-Financial Businesses and Professions (DNFBPs), and strengthen their alignment with recent adjustments to the Financial Action Task Force (FATF) methodology. This will be achieved by promoting best practices and creating a platform for constructive dialogue on challenges and opportunities. These efforts aim to establish a culture of corporate compliance and achieve the highest levels of sustainability.”

In his speech, H.E. Talal Al Teneiji, Director of the Executive Office for Control and Non-proliferation (EOCN), emphasized the collaborative nature of efforts to counter financial crime. He said: “Addressing financial crimes is not just a regulatory compliance matter; it is a shared responsibility that requires effective coordination among the public and private sectors, and across the international level.”

Al Teneiji highlighted the strategic importance of the DNFBP sector, saying, “We are proud of the valuable participation of the country’s government entities and the Designated Non-Financial Businesses and Professions sector- a strategic partner we value deeply and consider a vital line of defense in combating financial crime – in this summit. This sector plays a key role in shaping and implementing the requirements for control, counter-terrorism and the proliferation of weapons.”

H.E. also commended the UAE’s forward-looking approach to strengthening its legislative framework, saying, “Over the recent years, the UAE has made significant strides in updating its necessary legislative and operational systems to ensure full compliance with international obligations related to targeted financial sanctions aimed at countering terrorism financing and the proliferation of weapons.”

Highlighting EOCN’s recent efforts in capacity building, H.E. Al Teneiji noted that the Office has recently launched a specialized e-learning platform focused on targeted financial sanctions. Additionally, there are programs, guidelines, explanatory videos, awareness sessions, and presentations made available through the official website and communication channels. H.E. also highlighted a recently completed national study, developed in collaboration with both sectors, focused on assessing the risks associated with the financing of weapons proliferation across the country. The sessions shared the key findings from this study to contribute to mitigating risks associated with clients.

The two-day summit features a series of interactive discussions and studies of related patterns, addressing the means for combating financial crime. Additionally, a number of Memoranda of Understanding (MoUs) were signed, bolstering the UAE’s efforts to countering illicit finance and enhancing compliance with international standards.

-Ends-